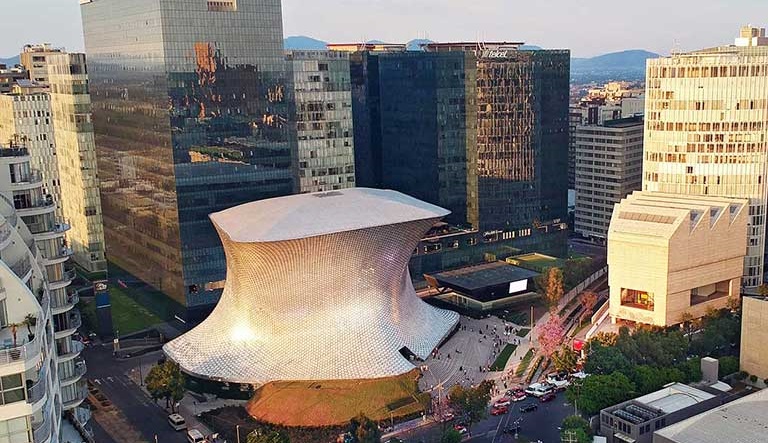

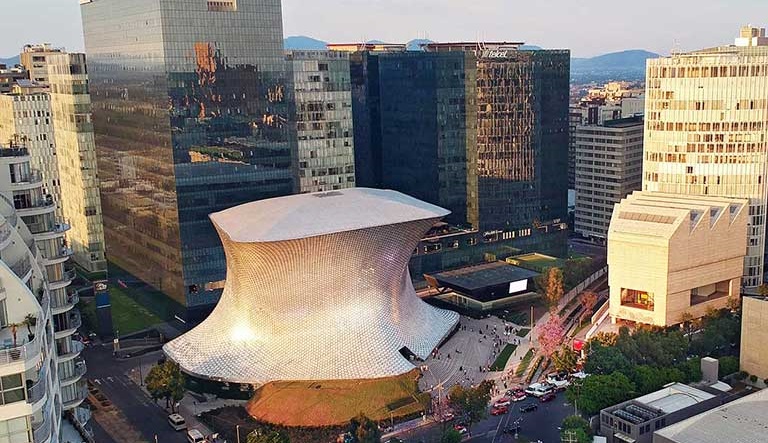

Ritch Mueller hosted the second edition of the Transactional Tax Conference, in which the panel of experts integrated by Óscar Lopez Velarde, Santiago LLano Zapatero, Juan José Paullada and Ximena García, addressed the following topics:

- Protection of the Afores’ exemption on investments in CERPIs and CKDs

- The benefits of the real estate FIBRA that are not being capitalized in the market

- Reg 144/A bonds beyond the 4.9% withholding tax

- Investments through SPACs

- Structures for accessing private bank managed capital

- New offshore investment structures for family offices and investment funds

- Risks in Mexican VC and Fintech structures

- Structuring of investments in Crypto, NFTs and DAOs

- Application of anti-abuse rules and reportable schemes when structuring transactions

- Permanent establishments for banks and private equity fund managers

- Recent tax developments: controlling beneficiary, legal representative of foreign residents and intercompany debt

The event brought together leaders from financial institutions, afores, investment funds and companies, to discuss trends in the legal and tax market in Mexico.